An asset-based loan (ABL) is a type of financing that uses the assets of a business as collateral. This type of loan is a great way for businesses to access capital quickly and efficiently. ABLs provide an alternative to traditional bank loans and can be a great option for businesses with limited credit histories or with short-term cash flow needs.

Asset-based loans are a type of financing that is secured by an owner’s business assets. Business owners use asset-based loans to access quick capital for a variety of purposes, such as expanding their business, purchasing new equipment, or managing cash flow. Asset-based loans offer a higher loan-to-value ratio than traditional financing, allowing business owners to leverage more of their assets to borrow more money.

What is an Asset?

A business asset is any resource owned or controlled by a business that has commercial or exchange value. Tangible assets are itemized and valued on your company’s balance sheet. To secure an ABL, you can use a variety of collateral such as real estate, inventory, accounts receivable, equipment, or other tangible assets. With ABLs, you are borrowing against the value of the asset.

How Asset-Based Loans Work

An asset-based loan is a loan that is secured by the assets of a business. Business owners apply for an ABL from a lender, like a bank or factoring company. The lender will typically assess the value of the assets and then offer a loan amount based on a percentage of that value. The borrower then pays back the loan plus fees and interest over a set period of time. The lender also has the right to seize the assets if the borrower fails to repay the loan.

ABLs are structured in a variety of ways, including revolving loans and term loans.

- Revolving loans are set up so that the borrower can draw on the loan as needed and repay the principal and interest as they use it.

- Term loans are set up so that the borrower receives the full amount of the loan and then repays it over a specified period of time.

Make sure to clarify which type of loan repayment is expected before you sign an agreement with any lender.

The amount of money that a business can borrow is mostly based on the value of the assets. The lender may consider things like cash flow, financial condition, and business history when determining the size of the loan. The ideal loan size will differ from lender to lender. For example, an ideal loan when working with Factor Funding is anywhere between $50,000 and $15 Million or higher, depending on your situation.

The capital secured by asset-based loans can be used for a variety of purposes, such as purchasing inventory, expanding a business, or providing working capital. Additionally, asset-based loans can be used for short-term financing needs, such as if the business needs to purchase supplies or equipment.

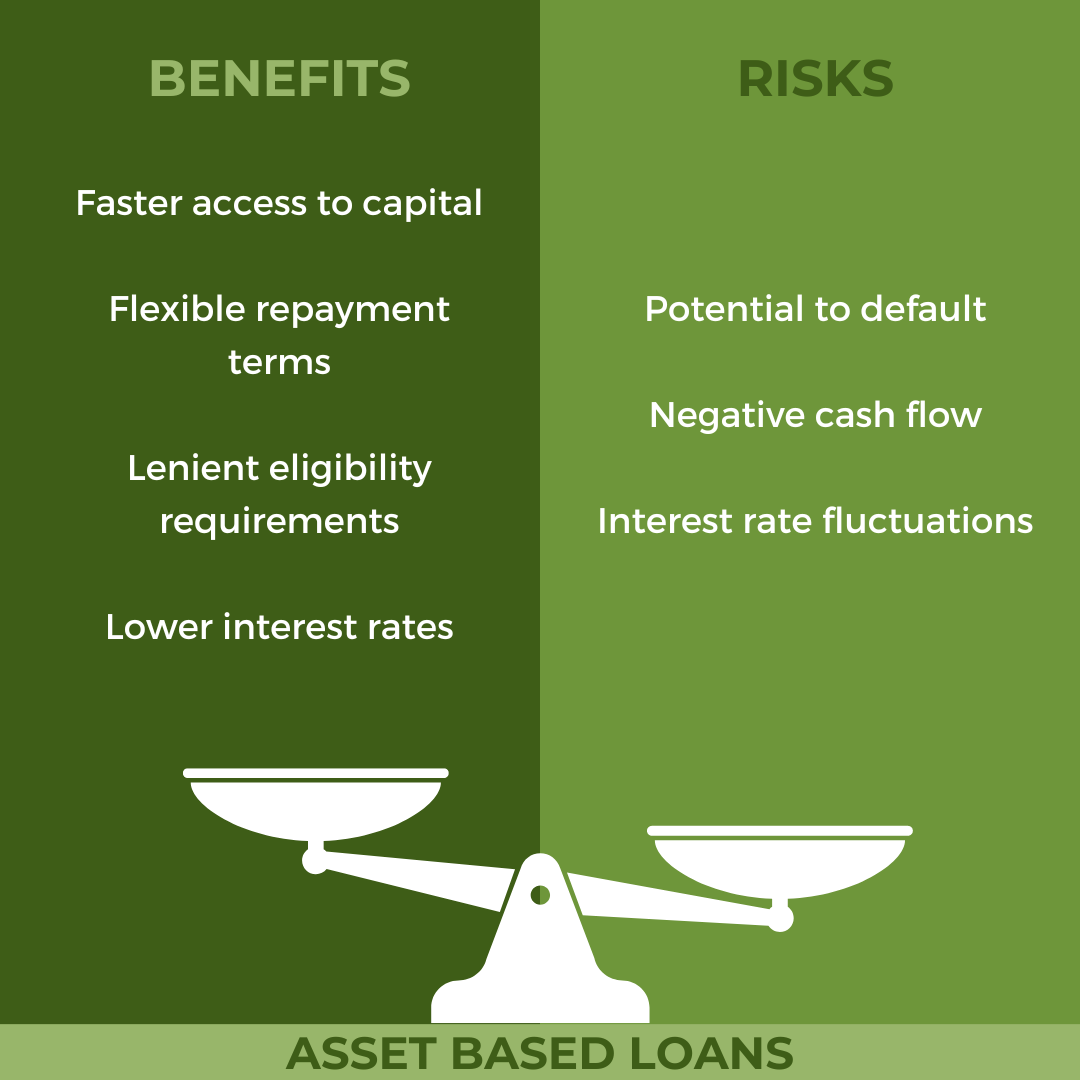

Benefits and Risks of Asset-Based Loans

An ABL can be a great option for businesses that need access to capital quickly and efficiently. It’s important to understand the benefits and risks of asset-based loans, and to make sure that your business has the capability to repay the loan before taking on this type of financing.

ABLs offer several advantages over traditional bank loans. These include:

- Faster access to capital: ABLs are typically processed more quickly than traditional bank loans and require less lengthy documentation.

- Flexible repayment terms: ABLs generally offer more flexible repayment terms than traditional bank loans.

- More lenient eligibility requirements: ABLs are often easier to obtain than traditional bank loans and can be a great option for businesses with limited credit histories or with short-term cash flow needs.

- Lower interest rates: ABLs typically have lower interest rates than traditional bank loans.

Of course, this might not be the right solution for every business. It’s important to be aware of the potential risks associated with ABLs. These include:

- Default: If a business is unable to repay the loan, the lender can take possession of the collateral.

- Negative cash flow: If a business takes on too much debt, it can lead to negative cash flow and make it difficult to pay back the loan.

- Interest rate fluctuations: ABLs typically have variable interest rates that can fluctuate over time, which can affect a business’s ability to repay the loan.

Your business will need to weigh the benefits and risks for your situation to determine if this is the right financing method for you.

What is the Difference Between ABL and Invoice Factoring?

An asset-based loan is a loan that is secured against an asset, such as a company’s inventory, accounts receivable, or equipment. Invoice factoring is a type of financing that allows companies to access working capital by selling their accounts receivables to a factoring company at a discounted rate.

The main difference between them is that with an ABL, the company will still own the asset, while with invoice factoring, the factoring company will take ownership of the accounts receivable.

What Business Owners Should Know Before Securing an Asset-Based Loan

Before signing an agreement with a lender, consider these five things.

- Understand the terms and conditions of the loan: Before securing an ABL, it is important to understand all of the terms and conditions of the loan. This includes the interest rate, repayment terms, and any other fees that may be associated with the loan.

- Check your credit: It is important to check your credit score before securing an asset-based loan. It’s possible to secure a loan even with bad credit, but a good credit score will help to ensure that you receive the best terms and conditions for your loan.

- Calculate your expenses: Before securing an ABL, it is important to calculate your expenses and make sure that you have enough cash flow to cover the loan payments. This will help to ensure that you are not putting yourself in a financial bind.

- Have collateral ready: Most ABLs require collateral in order to be approved. Make sure that you have the necessary collateral ready before you apply for the loan.

- Make a plan: It is important to have a plan for how you will use the funds from the loan. Make sure that you have a clear plan for utilizing the funds and that you have a timeline for repayment.

As mentioned before, ABLs are a great option for short-term financing, especially for small businesses with short credit histories. If you’re interested in securing this type of loan, getting the required documentation together ahead of time will speed up the application process.

Required Documentation for ABL Applications

Every lender has a different application process and different required documentation, but here’s what you can generally expect to provide:

- Collateral: A list of assets such as real estate, inventory, accounts receivable, or equipment that can be used as collateral for the loan, including their value and location.

- Financial Statements: Three years of income statements, balance sheets, and cash flow statements.

- Credit History: A record of the business’s creditworthiness, including a personal credit score for the business owner.

- Liability Information: Information on any current outstanding debts

- Financial Details: A copy of the applicant’s driver’s license and social security card

- Operating History: A detailed history of the company’s operations, including a list of customers and suppliers.

Any additional documentation needed should be listed on the lender’s application.

A Final Note

Asset-based loans are an excellent option for businesses looking to access capital quickly and easily. They provide a higher level of flexibility than traditional bank loans and can be used to finance a variety of projects and investments. Additionally, asset-based loans can be used to help you better manage cash flow and provide more security for lenders. With their wide range of benefits, asset-based loans are a great financing solution for many businesses.

If you’re interested in using business assets to get the funding your business needs, get in touch with Factor Funding today. Our team has decades of experience helping businesses get the quick funding they need to reach their goals. We look forward to helping your business succeed.