In the United States, nearly 70% of all freight tonnage is moved on trucks, according to the American Trucking Association. The trucking industry accounts for 12.8% of all fuel purchased in the U.S and is a vital piece of the American economy.

Though transportation companies serve a variety of different industries, it can be a challenging business. Cash flow depends on when your customers pay invoices while your bills continue to stack up every month.

If you own a transportation or freight company, you need to pay for new drivers, engine repairs, fuel, registration fees, and more. Sometimes, your daily costs can’t wait for an invoice to clear in 30, 60, or 90 days. Did you know the average time for invoice payment is 40 days? Or that almost 60% of payments are late?

How can your trucking company survive when your financial foundations are constantly shifting? The answer to your struggles is transportation factoring, a way to level your cash flow without endangering your property.

What Is Transportation Factoring?

Transportation factoring, also known as freight bill factoring, is the practice of selling invoices to a factoring company in exchange for immediate partial payment of their face value.

The factoring company, often referred to as a “factor,” becomes responsible for collecting on the invoice. Once it’s paid, the factoring company pays you the balance minus fees.

Factoring streamlines your cash flow, so you have revenue available to use for your business right away. Most factors pay anywhere from 80% to 97% of invoice face value and charge fees of around 1.5% to 5%. And unlike a traditional business loan, there is no collateral required, so you don’t have to worry about your credit score.

Consider the biggest challenges for any transportation company, particularly owner-operators:

- Little usable income for operations and payroll due to last-minute or late invoice payments

- Expansion constraints due to the need to use your cash on hand

- Payroll constraints due to uneven invoice payment, which can lead to the loss of employees and reputation

- Fuel cost constraints since the price of fuel fluctuates daily, and a steep spike in fuel costs can cripple your company by sidelining your trucks

- Constraints on the growth and survival of your company as it’s too risky to borrow against your collateral when invoices are paid late or not at all

Freight factoring can reduce or eliminate every one of these constraints and help your business grow.

Transportation Factoring Process

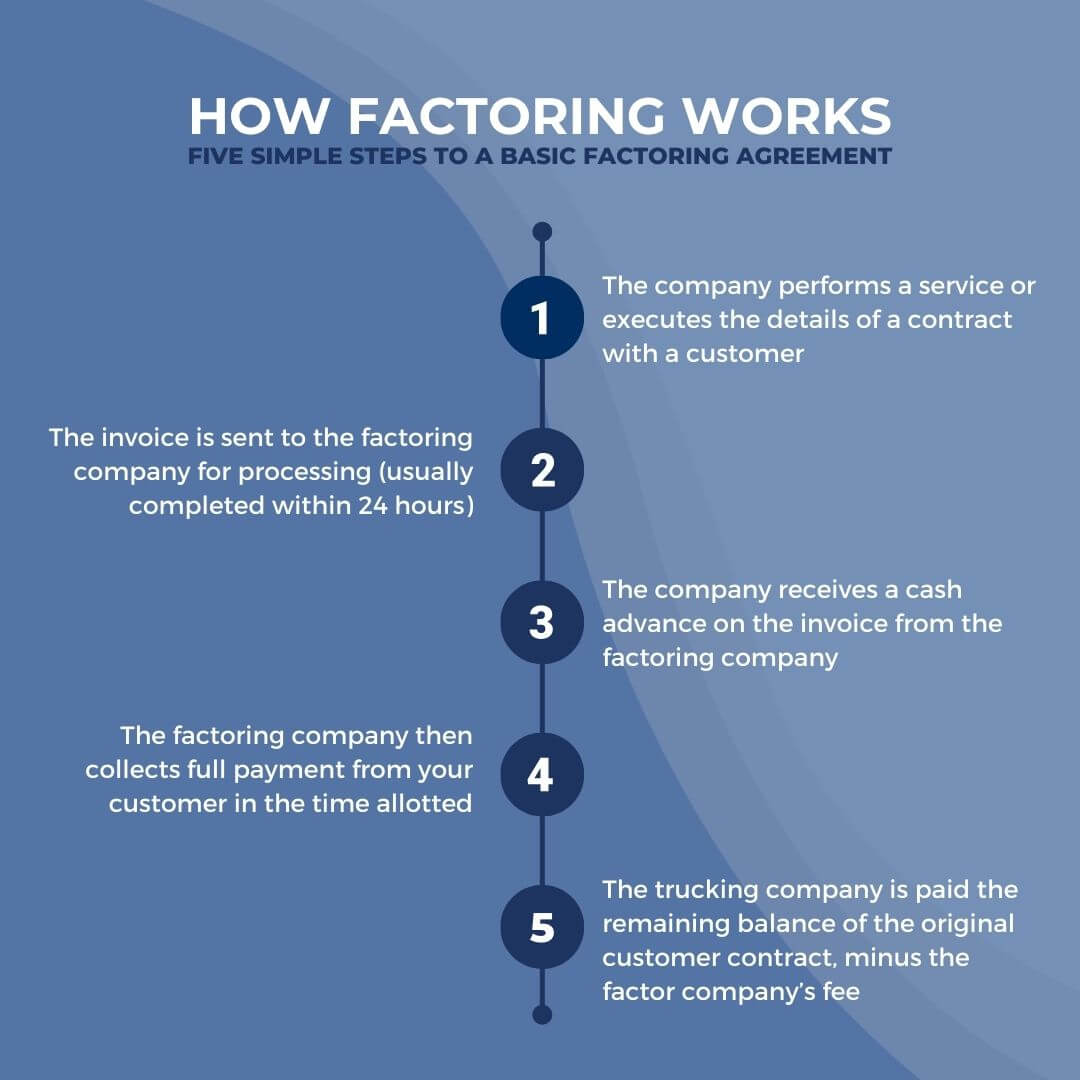

The transportation factoring process is relatively simple and can can help your transportation company meet all its financial needs.

Once you deliver your load, you send your rate certification and bill of lading (BOL) to the factoring company. Once the factor verifies the load, you receive a significant portion of the BOL in cash, typically within 24 to 48 hours. However, some factors provide funding even quicker.

The factor then assigns an account manager to collect the invoice while you find your next load. Once the bill is paid in full, the factor sends along the invoice balance minus a factoring fee.

Most factoring business takes place online. You can submit invoices using a tablet or smartphone and check on their status. You can also receive cash via check, electronic transfer into your bank account, or on a card.

Types of Factoring

Transportation funding is offered as recourse or non-recourse factoring. The difference lies in a particular clause in your factoring contract:

- Recourse factoring - you are responsible if the customer defaults on payment.

- Non-recourse factoring - the factor is responsible if the customer defaults on payment.

Say your contract has a clause that permits the factor recourse, and one of your customers doesn't pay their bill. After diligent attempts to collect, the factor requires you to buy back the invoice and take on the collection.

Non-recourse factoring means the factor does not expect you to buy back the invoice. Instead, the factoring company takes the loss. However, this is typically only true in limited circumstances laid out in the contract for customers who declare bankruptcy or go out of business.

To reduce their risk, factoring companies seek reasonable assurance that your customers will pay their bills. The factor performs a credit check on your customer before accepting the invoice for factoring. Factors are more likely to buy invoices from customers with good credit because they pose a lower risk of nonpayment.

To avoid the denial of invoice factoring, you might take advantage of a pre-approval list of customers provided by the factor, so you know in advance that the customer is credit-worthy and their invoices are acceptable for factoring. If a particular customer is not on the list, you might be able to get the factor to perform a credit check ahead of time and before you provide services for that customer.

Who Uses Factoring?

Transportation factoring is appropriate for any transportation, freight, or trucking company. It’s especially helpful for small business owners like owner-operators who spend a lot of time on the road and don’t have time to mess with finances. Many owners don’t have the cash reserves to wait on their customer's convenience to pay.

Factoring companies don't limit the amount you can finance since they buy invoices instead of lending money. Also, there is no minimum or maximum invoice volume to meet, although higher volumes usually translate into lower fees.

You don’t even have to factor all your invoices; you can pick and choose which to factor. Potential invoices must only meet the factor’s acceptance guidelines for terms and conditions. Your customers don’t even need to know you are factoring the invoice, although most of them are probably familiar with the practice.

The Benefits of Factoring

Factoring literally takes a load off of your business. When you factor your invoices, you have no need to hire back-office collections workers or take the time to do it yourself.

You receive money nearly instantaneously upon submitting your invoices, providing a timely boost to your cash flow. You can tailor the amount of cash you need and when you need it. Plus, there is no ceiling to the amount you can factor. Your line of credit is based on your current sales, not your net worth.

Factoring is based on your customers' credit history and score, not yours. If you have bad credit, you can still receive funding at reasonable rates because the factor is banking on your customer’s solvency and reliability.

Best of all, factoring does not show up as a debt in your ledger, so if you seek a traditional bank loan, you don’t have a load of debt to explain.

Factoring works for all types of businesses, from start-ups to established companies. It frees up cash to:

- Hire more drivers

- Repair or replace an engine or a truck

- Make a down payment on new equipment

- Pay your taxes, insurance premiums, and registration fees

- Grow your business

When you have the money in hand, you can confidently take on more work because you better maintain your equipment and plan ahead for future growth.

What to Expect When Applying to a Factoring Company

When you apply to a factoring company, they will want to know the following:

- Your monthly invoice volume

- Your customer base in volume (ex. Do you work for multiple brokers or just one?)

- The average number of days it takes your customers to pay

- How much of the invoice face value you require to operate

When you apply for factoring, you avoid common bank loan approval tactics like rigorous credit checks, collateral appraisal, and extensive paperwork. Banks also limit the amount of money you receive at a time. With factoring, you receive cash within hours based on the invoices you factor.

The factor will only advance part of the invoice face value to manage their risk. Also, the more customers you have in your base, the lower the risk that a business disruption will create problems. As mentioned above, the more invoices you factor, the lower the fees.

What to Look for in a Factoring Company

Not all factoring companies will be a good fit for your business. When searching for a factoring company, always ask questions. Here are some recommendations on what to ask factors before signing a contract:

- What are the fees? Understand upfront how much you will be asked to pay for the service. You need to know the terms and conditions so you know when or if those fees can be increased or decreased. Look for a company that is transparent about their fees. Click here to learn more about Factor Funding’s pricing.

- Are there any penalties? Ask if there are circumstances under which you might be charged a penalty. If so, is there a way to avoid it? Get the answer in writing as part of the contract.

- What about reporting? How often will you be notified of collections and progress? What is included in the reports, and what is left out?

- What percentage of the invoice’s face value will the factor advance and when? Do you want all your money on the day of invoice submission, or do you want to set up a reserve account at the factor?

- What other services are offered? Many factors offer multiple services that could be beneficial to your business. In particular, ask about any value-added options and their cost. What can they do that their competitors don’t?

Services factors may offer include:

- Dispatching services

- Fuel cards

- Small business loans

- Tire discounts

- Roadside assistance

- Truck or trailer financing

- Extended hours or open on weekends and holidays

- Insurance down payment assistance

Research their service reputation and make sure they understand the trucking industry. Ask about their prior performance as a factor. Check out Factor Funding’s transportation page to learn more about how our solutions can meet the unique demands of this industry.

Some additional things to consider:

- Find out what the factor does about aging invoices. If the factor doesn't advance the total amount, they probably include aging fees in the contract. Additional fees increase your costs, and the longer it takes your customer to pay, the more you pay in aging fees.

- Note the clearance days for checks. The factor may have seven days of clearance, meaning that they apply it to your account seven days after they receive the customer's check.

- Find out when the factor must receive the invoice for same-day payment. The factor may have a cutoff time, so they may send advances on invoices received after noon the next day by ACH.

Finally, always know how to terminate a contract with a factor. Most factors sign limited time agreements, but you are often required to submit a termination notice a specific number of days before the contract ends; otherwise, you are automatically renewed. Make sure you discuss this with the factor before signing the contract.

How to Apply for Factoring

Applying to a factoring company is simple. You complete questions on the application, usually through an online portal. The factor will ask for certain documentation. Then the factor reviews your application, and a representative contacts you about the status of your business and your options.

After approval, the factor finalizes the arrangements and links you to a funding page.

It's no more complicated than applying for a credit card.

Transportation factoring can keep your business going and growing. There is no credit check, and you have no limit on the number of invoices you can sell. As long as your customers are reasonable credit risks, you can factor invoices and receive nearly the entire face value within a few minutes to a couple of days.

Factor Funding is here to answer any other questions you have. Contact us today to learn more about how we can accelerate your cash flow.