In the world of small business financing, entrepreneurs often need to explore various options to secure funds for their operations, expansion, or unexpected expenses. If your business is new or doesn't have a great credit history, you are unlikely to find a favorable financing solution with traditional bank loans. Alternative financing solutions can offer the speed and flexibility that traditional methods lack.

One such option is the merchant cash advance (MCA). This guide provides an overview of merchant cash advances, including how it works, advantages and disadvantages, and considerations. We aim to equip you with the necessary knowledge needed to make an educated choice on business financing.

What is a Merchant Cash Advance?

A merchant cash advance is a type of financing that provides businesses with a lump sum payment in exchange for a portion of their future credit card sales or daily revenue. With this type of financing, a lender is essentially buying your future sales so you can use that money now to cover momentary expenses.

A MCA is not a loan in the traditional sense, but rather an advance against future earnings. A merchant cash advance is a good option for businesses that have a high volume of credit card sales, such as retail stores, restaurants, and e-commerce businesses. But, other types of industries can also make use of merchant cash advances.

How a Merchant Cash Advance Works

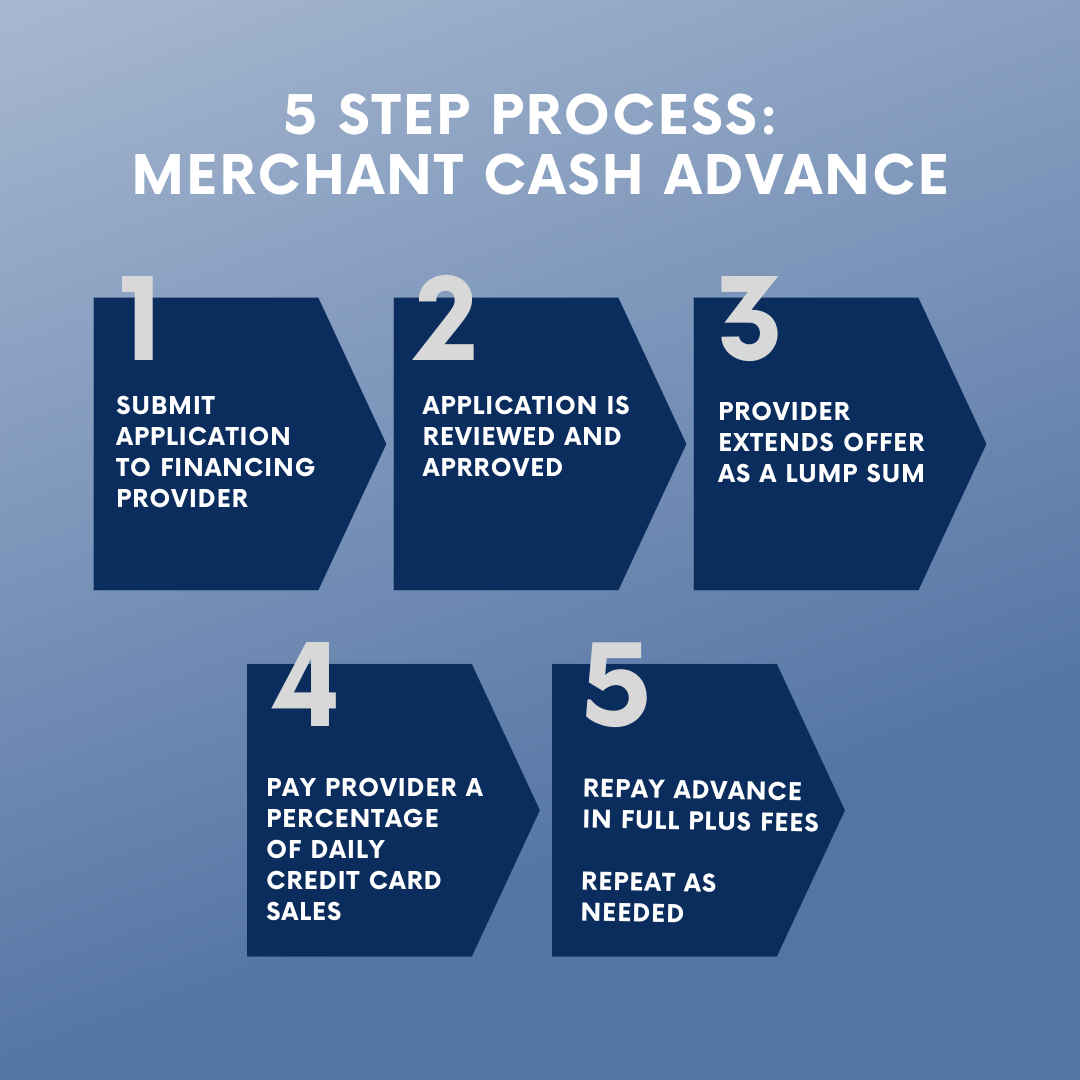

The financing process is straightforward and involves 5 steps:

-

Application: To apply for a merchant cash advance, you must first submit an application to a financing provider. The application typically includes information about your business's credit card sales, revenue, and other relevant financial details.

-

Review and Approval: The financing provider reviews the application and assesses your business's creditworthiness. Unlike traditional loans that heavily rely on credit scores, merchant cash advance providers consider the volume of credit card sales and your business's overall revenue.

-

Offer: If approved, the financing provider will offer you a lump sum amount, provided upfront. The specific amount that you can receive as an advance will primarily depend on the average sales you generate through credit card transactions or bank deposits.

-

Repayment: The repayment process of a merchant cash advance differs significantly from traditional loans. Instead of fixed monthly payments, you will pay back a percentage of daily credit card sales to the MCA provider or by draft from your bank account. This is known as the "holdback" or "retrieval rate." The percentage, or amount, is decided during the application process and remains constant until the advance is fully repaid.

-

Repayment Completion: The MCA provider works in tandem with the credit card processor to automatically deduct the agreed-upon percentage from each credit card transaction, or scheduled bank draft. This process continues until the advance, along with the specified fees, is fully repaid.

Some MCA providers do offer the option of a fixed monthly withdrawal directly from your bank account for repayment. The fixed amount is calculated based on estimated revenue and will not change with sales. Talk to your MCA provider and verify what repayment options they offer before signing an agreement.

Once your total advance is repaid, you can repeat the process as many times as needed. An established relationship with a trusted MCA provider will eliminate the need for the first two steps of the process, so it is very quick and easy to get usable funds when you need it.

Advantages and Disadvantages

As with any financing methods, there are pros and cons to consider when you are researching merchant cash advances. Advantages include:-

Quick Access to Funds: The application and approval process for an MCA is typically much faster than traditional loans, making it an attractive option for businesses that are in need of quick capital.

-

Flexible Repayment: In most cases, because repayment is based on a percentage of daily credit card sales, businesses don't have to keep up with fixed monthly payments, unless required otherwise. Repayments adjust according to sales, potentially easing financial strain during slower periods.

-

No Collateral Required: MCA providers are primarily concerned with the business's revenue stream, so they usually don't require collateral for approval.

-

Credit Score Flexibility: Businesses with lower credit scores may still qualify for an MCA if they have a strong history of credit card sales.

Certain types of businesses will see more benefits from these factors than others. Disadvantages include:

-

Expense: An MCA is often more expensive than other types of financing. The annual percentage rates tend to be much higher than those of conventional loans.

-

Flexible Repayment: While the flexible repayment structure can be a benefit, it can also be a drawback. Repayments are directly tied to sales, meaning that during slower sales periods, you still have to meet repayment obligations.

-

Impact on Profit Margins: Because merchant cash advances involve a percentage of daily credit card sales being paid to the MCA provider, your business's profit margins can be impacted. During periods of high sales, you will be paying a larger amount towards the advance, potentially cutting into profits.

-

Limited Borrowing Capacity: The amount you can borrow through an MCA is limited to a percentage of average monthly credit card sales, or bank deposits. This might not be sufficient for larger capital needs, limiting the usefulness of MCAs for certain expansion or investment plans.

Depending on your needs and business type, merchant cash advances may or may not be the best financing option available. Weigh the pros and cons for your specific situation and compare your findings to other alternative forms of financing.

You can also ask a financing professional that has experience working with multiple types of business financing and business owners in different industries to help you decide. Factor Funding has helped small businesses find funding for over 25 years and can provide guidance on which financing method is best for your business. Contact our team here.

The Cost of Merchant Cash Advances

It's true that merchant cash advances may not have the best reputation among business owners. As one of the most expensive forms on financing available, it will not be not the best option for every business out there. A merchant cash advance is a great option for a small business that doesn't have the credit history to secure a traditional loan, is seeking financing to fulfill urgent business needs or fund growth opportunities, and earns a majority of their money through debit or credit sales.

It is very important to properly research an MCA provider before signing an agreement with them. Unethical, predatory scammers can trap you in unfavorable contract terms that put your finances at risk. Look for a provider that years of experience, a good reputation, and knowledge about your industry and the financing world. Don't be afraid to ask for clarification on contract terms, and make sure you completely understand all details before agreeing.

Am I Eligible?

Eligibility requirements for merchant cash advances will differ from provider to provider. At Factor Funding, this type of financing is available for businesses that have:

- Been in business for at least 9 months

- Four months of credit card processing or bank statements

- Accepted MasterCard and Visa credit card payments

If you are interested in applying for a merchant cash advance, expect to be asked to provide a variety of financial information about your business. MCA providers will use these details to determine eligibility and the amount which you can advance.

Required documentation to submit with your application may include copies of the following:

- 4 months of bank statements

- Business setup documents; Articles of Incorporation or Assumed Name certificates

- Copy of applicant's government-issued photo ID/driver’s license & social security card

- Copy of business/liability insurance

- Customer list

- IRS Federal Tax Identification #/W-9

You will also most likely be asked to provide your business' monthly credit card volume and annual gross revenue. This list is not comprehensive, but it is a good place to start.

Final Thoughts

To conclude, a merchant cash advance is a unique form of financing that can be a valuable tool for businesses in need of quick capital, particularly those with a substantial volume of credit card sales or delayed payments. However, it's essential for business owners to thoroughly understand the terms, costs, and potential impacts on cash flow before opting for this financing option. Consulting with financial advisors or professionals can provide additional insights and help determine if an MCA aligns with your business's needs and financial health.